Which One of the Following Is a Capital Structure Decision

All of the above. Multiple Choice О O Which one of two project proposals should the firm Implement.

Capital Structure Theory Modigliani And Miller Mm Approach Social Media Optimization Learn Accounting Accounting And Finance

Andor equity Equity Value Equity value can be defined as the total value of the company that is attributable to shareholders.

. How much debt should. Setting the terms of sale for credit sales. C Outright decisions D Capital structure decisions Answer.

O Determining Which One Of Two Projects To Accept O Determining How To Allocate Investment Funds To Multiple Projects. Determining how much debt should be assumed to fund a project E. Determine when suppliers should be paid.

Capital Budgeting is a part of. Establishing the preferred debt-equity level C. Capital structure refers to the amount of debt Market Value of Debt The Market Value of Debt refers to the market price investors would be willing to buy a companys debt at which differs from the book value on the balance sheet.

Capital structure decisions include determining. How much funding should be allocated to financing customer purchases of a new product. Which one of the following is a working capital management decision.

Setting the terms of sale for credit sales E. O Determining the amount of funds needed to finance customer purchases of a new product. Determining the optimal inventory level B.

At optimal capital structure the k 0 of the firm is highest. Setting the terms of sale for credit sales. Every capital is the optimum capital structure as per NOI approach.

A good capital structure provides firms with the flexibility of increasing or decreasing the debt capital as per the situation. Determining how to allocate investment funds to multiple projects. Which one of the following is a capital structure decision.

Capitalization structures also refer to the percentage of funds contributed to a firms total. Determining the number of shares of stock to issue to fund an. According to Net Income NI approach capital structure decision is relevant in the valuation of firm.

O Determining which one of two projects to accept O Determining how to allocate investment funds to multiple projects. Determining the amount of funds needed to finance customer purchases of a new product D. Which one of the following is a capital structure decision.

Which one of the following is a capital structure decision. Selecting new equipment to purchase. Answer - Cash flows.

O Determining How Much Inventory Will Be Needed To Support A Project. Which one of the following is a capital structure decision. Depending on the sources of financing we can distinguish borrowed or debt.

Capital structure describes the mix of a firms long-term capital which consists of a combination of debt and equity. Which one of the following is a capital structure decision. Capital Structure in General.

Amount of debt to assume. Determining the optimal inventory level. In NOI approach says that there is no optimal capital structure.

A sound method of capital budgeting is based on. The proportion of debt and equity in the capital configuration of a company. Determining which of two projects to accept.

Which one of the following is a capital budgeting decision-Determining how many shares of stock to issue-Deciding whether or not to purchase a new machine for the production line-Deciding how to refinance a debt issue that is maturing-Determining how much inventory to. What is Capital Structure. Establishing the preferred debt-equity level.

Which one of two projects to accept. Determining how much debt should be assumed to fund a project. Capital structure is a.

Establishing the preferred debt-equity level. Which one of the following is a capital structure decision. Determining how to allocate investment funds to multiple projects.

Determining the amount of funds needed to finance customer purchases of a new product. A proper capital structure helps in maximising shareholders capital while minimising the overall cost of the capital. How should the firm allocate its limited available funds among acceptable projects.

The amount of funds needed to finance customer purchases of a new product. Determining the amount of long-term debt required to complete a project D. To be more specific capital structure is a ratio of short-term long-term liabilities and equity.

Every company needs capital to support its operations. Establishing the preferred debt-equity level. Approximately IRR is inverse of.

Which one of the following questions involves a capital structure decision. Determining which one of two projects to accept. Determining the amount of equipment needed to complete a job B.

Which of the following statement is false. Determining whether to pay cash for a purchase or use the credit offered by the supplier C. Determining how to allocate investment funds to multiple projects C.

Following are the factors that play an important role in determining the capital structure. A firm can change its total value and its overall cost of capital by change in the degree of leverage in its capital structure. Capital structure is a blend of a companys sources of finance and consists of several types of funding.

Which one of the following is a capital structure decision. In the context of the above two statements which one of the following options is correct. How to allocate investment funds to multiple projects.

Answer - Investment Decision. Selecting new equipment to purchase. Tutorial 1 answer smn224 tutorial assignment for topic1 solutions capital structure decisions include consideration of the.

Factors Determining Capital Structure. None of the above. Determining which one of two projects to accept B.

Which One Of The Following Is A Capital Structure Decision. O Determining The Amount Of Funds Needed To Finance Customer Purchases Of A New Product. Determining how much debt should be assumed to fund a project.

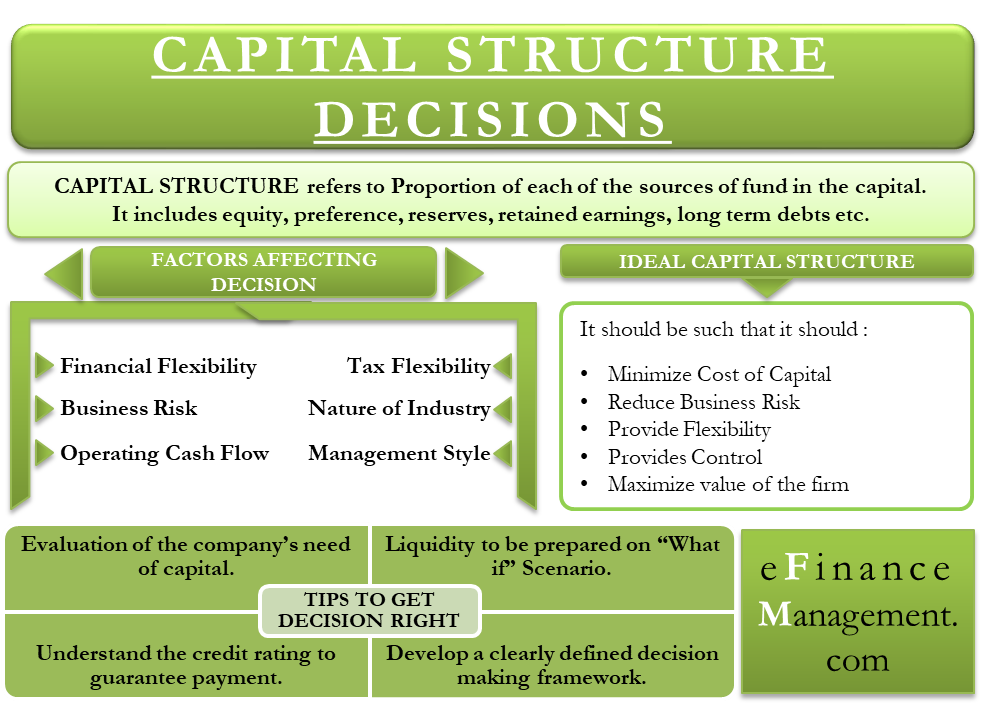

Capital Structure Decisions Importance Factors Tips and More. Powered by WP Quiz. Determining the optimal inventory level.

Selecting new equipment to purchase D. Answer - At optimal capital structure the k 0 of the firm is highest. The traditional approach is also known as.

Determining when supplies should be paid. Capital Structure as the name suggests means arranging capital from various sources in order to meet the need for long-term funds for the business. In case the firm wants to grow at a faster pace it would be required to incorporate debt in its capital structure to a greater extent.

It is the combination of equities preference share capital long-term loans debentures retained earnings along various other long-term sources. O Determining how much inventory will be needed to support a project. Determining the amount of funds needed to finance customer purchases of a new product.

D Capital structure decisions.

Capital Structure Decisions Importance Factors Tips And More

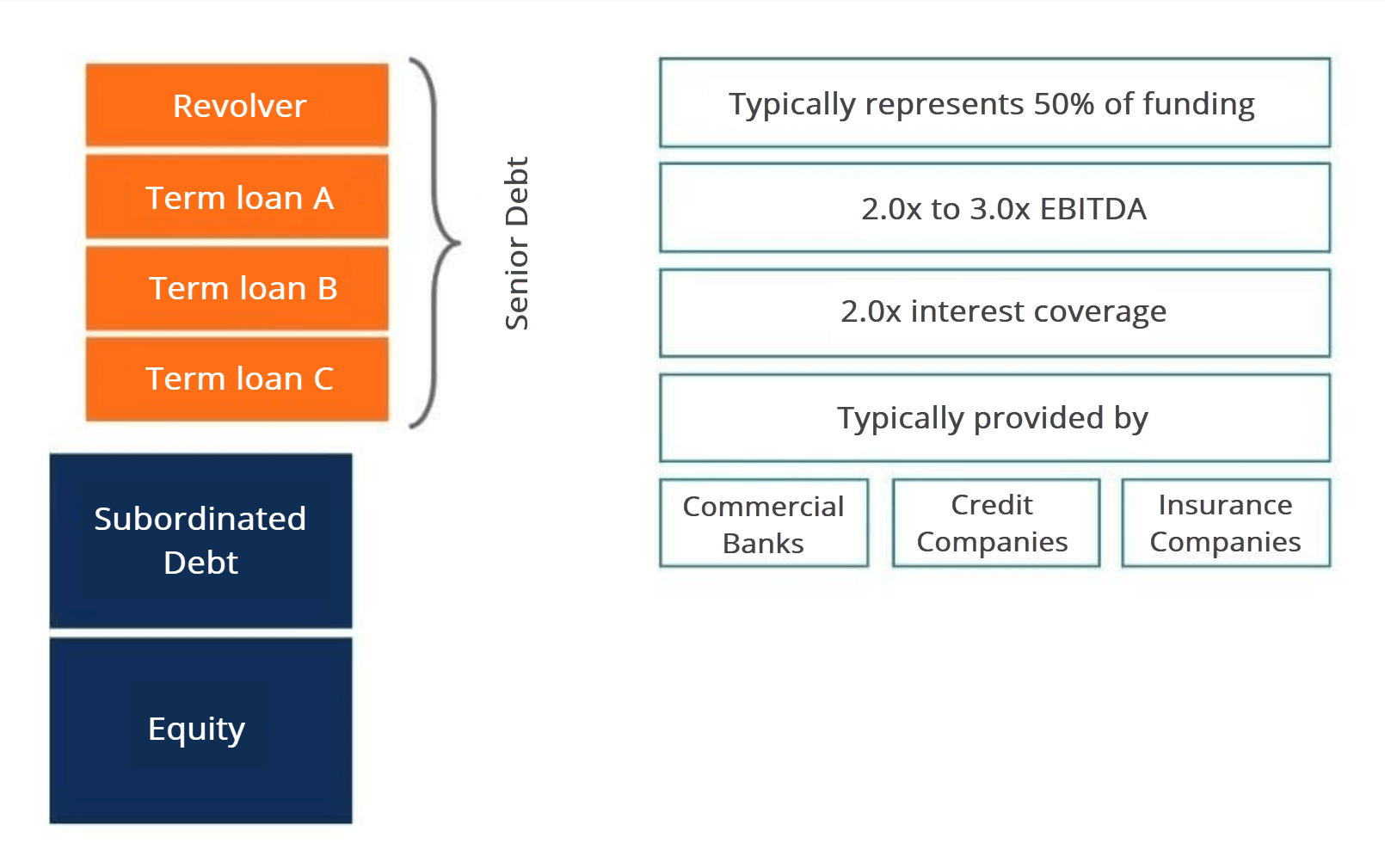

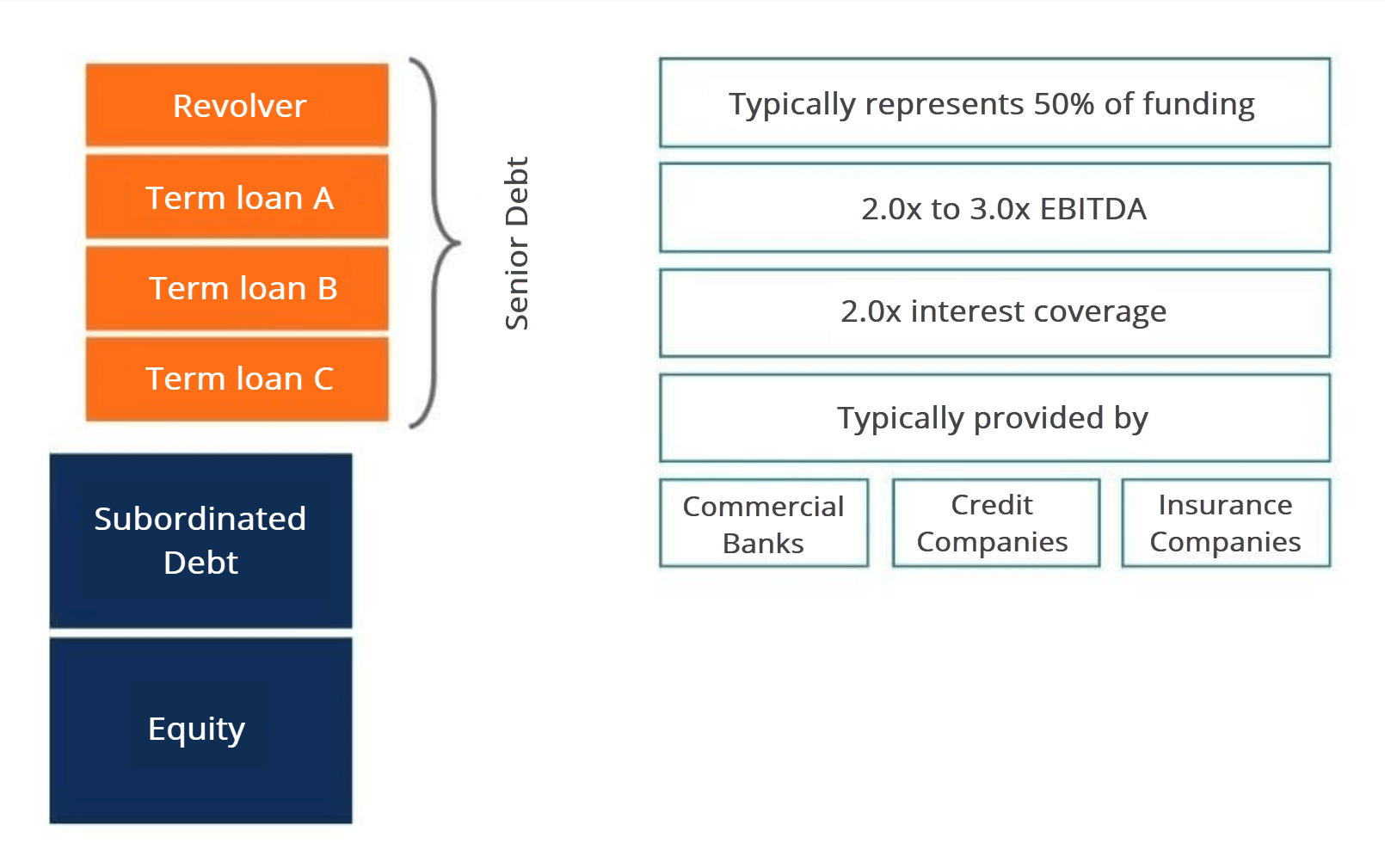

Senior And Subordinated Debt Learn More About The Capital Stack

Capital Structure Theory Traditional Approach In 2022 Cost Of Capital Debt To Equity Ratio Financial Management

Comments

Post a Comment